If your business relies on low-cost international shipments, the 2025 de minimis rule changes could be the shake-up you didn’t see coming. This trade policy has been a game-changer for global e-commerce, but 2025 is about to shake things up.

Recently, there’s been a huge surge in low-value shipments coming from China to the U.S., mainly fueled by the rise of dropshipping and e-commerce platforms like Shein and Temu. Current estimates are that over 1 billion packages enter the U.S. through these means each year. (Source: Reuters).

However, as the volume of these shipments grows there is increased scrutiny, especially with proposed rule changes aimed at leveling the playing field for U.S. businesses.

The eCommerce landscape, particularly in fashion, is changing fast. One key update—the 2025 changes to the de minimis rule—could drastically impact how dropshipping businesses operate. Here’s everything you need to know about what’s on the horizon for U.S. eCommerce store owners.

What Is the De Minimis Rule?

De Minimis, or “lacking importance”, shipments are those goods entering the U.S. valued below a certain threshold that is exempt from duties, customs, and taxes. Under this rule, shipments valued at $800 or less can enter duty-free, avoiding long customs checks. It’s a sweet deal for international businesses, making it way easier to ship products into the vast US market without extra costs.

For years, this rule has been a win for these shipments, allowing them to send products directly to U.S. consumers without added expenses. Dropshipping from China has become a cheap solution for many eCommerce brands. By bypassing customs duties, platforms like AliExpress and Shein thrived, enabling low-cost products to reach U.S. consumers cheaper and more quickly. However, the surge in these shipments led to concerns about lost tax revenue and competition with U.S. businesses.

Changes to the “de minimis” loophole will reconfigure the existing supply chain for eCommerce textile transactions.

Here’s why The US Is Closing the “de minimis” loophole

In case you’re not familiar, dropshipping is a business model where sellers market products online without holding any stock. Instead, when a customer places an order, the item ships straight from the manufacturer—usually in China—right to the consumer. Many Chinese dropshipping companies & eCommerce giants like Shien & Temu rely on the de minimis exemption to ship small packages directly to U.S. buyers. While this makes things cheaper and faster, it also raises some red flags:

Economic Competition:

U.S. retailers argue that Chinese sellers get an unfair advantage by skipping out on tariffs and duties, while U.S. businesses do contribute to US taxes.

Quality and Safety Concerns:

Because of the high volume of shipments, U.S. Customs and Border Protection (CBP) can’t always do thorough checks, which means more fake or unsafe products could slip through the cracks. Abuses and unsafe products from Shien & Temu are well documented and are certainly raising eyebrows within the US Government and EU.

Loss of Tax Revenue:

The de minimis rule leads to lost tax revenue since these shipments don’t go through the usual import duties.

Others are doing the same:

The European Union removed “de minimis” loopholes as of 2021.

Why the 2025 Trade Rules Are a Game-Changer for Your Business

While this change won’t immediately upend all international logistics, these types of governmental and regulatory changes slowly shift the balance of trade and alter how and which supply chains are most efficient for businesses and consumers.

The big-picture economics at play are two driving forces;

Dropshipping from overseas to the US just got a lot harder & more expensive

New shipments coming from overseas will no longer sail past customs and be completely duty-free. Additionally, shipments that don’t have proper documentation could be held in customs, lost, or never make it to their intended recipients. There is no question about it, closing the de minimis loophole will make it harder to use overseas fulfillment strategies to service the US market.

US Based Manufacturing & Fulfillment Will Become More Efficient

If you haven’t lined up US-based manufacturing and fulfillment for your US customers, now is the time to do it! Utilizing US-based manufacturers and fulfillment providers will ensure you don’t have to deal with additional documentation, taxes, and customs.

Don’t wait until you begin to experience problems with international shipments coming into the US, to start looking for US companies to work with. As of writing, US tariffs on China, are at 25% for textile products, but these could also increase in the coming years.

Don’t wait until you begin to experience problems with international shipments coming into the US, to start looking for US companies to work with. As of writing, US tariffs on China, are at 25% for textile products, but these could also increase in the coming years.

What are the upcoming changes to US customs, duties, and taxes for imported shipments?

The upcoming changes to U.S. trade rules are poised to significantly alter how businesses that rely on international manufacturing fulfill US-based orders. Let’s dive into what this means for businesses.

1. Exclusion of Tariffed Goods from De Minimis Exemptions

China-based manufacturers, heavily reliant on exporting low-cost goods to the U.S., will face new financial barriers. Dropshipping businesses that depend on these suppliers may need to absorb higher costs or pass them on to customers, making them less price-competitive.

The most significant change is the exclusion of goods subject to tariffs (e.g., Section 301 for trade imbalances and Section 232 for national security). This means:

- Many products previously exempt under the $800 de minimis rule will now incur duties, increasing costs for businesses relying on China-based suppliers.

- Businesses will need to factor these tariffs into their pricing models, potentially reducing their competitive edge in the market.

2. Stricter Reporting Requirements

For businesses, this adds complexity to logistics. Companies that ship large volumes of goods may need to invest in compliance tools or hire customs experts, adding to their operational costs. For smaller e-commerce businesses, this could be a significant hurdle.

Sellers will be required to provide detailed shipment information, including:

- Accurate product classifications under the Harmonized Tariff Schedule (HTS).

- Full transparency about product origins and value.

3. Leveling the Playing Field for U.S. Businesses

For businesses using China-based manufacturing, this change could erode their price advantage over domestic competitors. U.S.-based businesses may gain a foothold as consumers increasingly value local production and shorter delivery times.

Historically, foreign sellers using the de minimis rule have had an advantage over U.S. businesses, bypassing duties that local companies must pay. By tightening these exemptions, the U.S. government aims to:

- Ensure that all sellers, regardless of location, operate under similar cost structures.

- Protect U.S.-based businesses from unfair competition.

4. Addressing Counterfeit and Unsafe Products

One key reason for these changes is the prevalence of counterfeit or unsafe goods entering the U.S. under the de minimis rule. With limited customs inspections for low-value shipments, harmful or substandard products have slipped through the cracks.

For businesses using reliable, high-quality suppliers in China, these changes may inadvertently increase costs and delays, even if their products meet safety standards. This could push some companies to reevaluate their supply chains and prioritize suppliers in regions with stricter quality controls.

5. Recovering Lost Tax Revenue

While this may benefit the U.S. economy overall, it presents new challenges for businesses reliant on China-based manufacturing, as they’ll need to adjust to a more costly regulatory environment.

The de minimis rule has enabled foreign sellers to bypass duties and taxes, leading to significant revenue loss for the U.S. government. These changes aim to:

- Close the loophole by ensuring more shipments are subject to tariffs.

- Recover funds that can be reinvested into domestic infrastructure and programs.

Key Impacts on Dropshipping Outside the US To The US

Increased Costs

- Duties and Taxes: With more goods excluded from the de minimis exemption, drop shippers will face additional duties and taxes.

- Compliance Costs: The new reporting requirements will increase operational costs as businesses invest in systems to ensure compliance.

Reduced Profit Margins

Higher costs and compliance expenses will force businesses to either absorb the extra costs or pass them on to customers, potentially shrinking profit margins.

Supply Chain Disruptions

The added costs and delays on Chinese imports may make sourcing from China less viable. Businesses may need to find alternative suppliers or look to U.S.-based or other international options.

Longer Delivery Times

Stricter customs checks and additional paperwork will lead to delays, making shipping times longer for customers.

New Opportunities and Why It’s Time to Shift to U.S. Production

Shift to U.S.-Based Suppliers

Sourcing from U.S.-based suppliers provides more than just faster shipping and fewer customs delays. It ensures better quality control, enhances reliability, and builds stronger trust with your customers. Keeping production local allows businesses to remain competitive in an evolving market.

Focus on High-Quality Products

Offering premium-quality products can justify higher prices, helping businesses sustain profit margins while meeting the expectations of customers who prioritize value and durability.

Diversify Supply Chains

Look into suppliers in countries with favorable trade agreements or lower duties. This reduces reliance on China and provides more flexibility.

Strengthen Brand Identity

Emphasizing ethical sourcing, local production, and compliance can help build customer trust and appeal to those who prioritize sustainability.

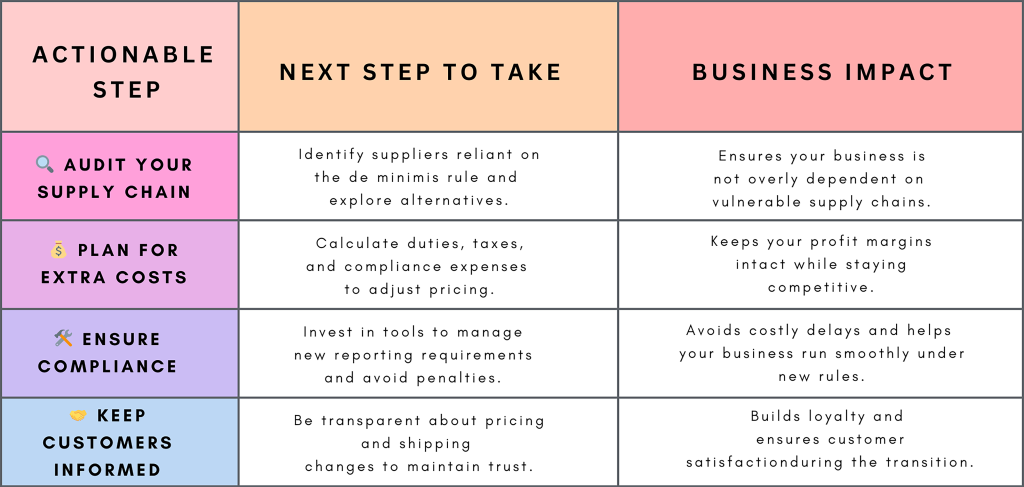

How to Prepare Your Dropshipping Business

What This Means for Clothing Brand Owners

The changes will hit clothing brands differently, depending on where they source their products. If you’re using U.S.-based production—like print-on-demand or local manufacturing—this is good news! The proposed changes help create a more level playing field, making it easier to compete with overseas imports.

But if your production is based in China, whether for dropshipping or print-on-demand, you could face increased costs and more complicated logistics. Now might be the right time to think about shifting your production back to the U.S. and tapping into local supply chains.

The Future of E-commerce – The Bigger Picture

The 2025 trade rule updates are a pivotal moment for e-commerce. The tightening of the de minimis rule is part of a bigger effort by the U.S. to address trade imbalances and ensure fair competition.

On a global scale, these changes are pushing trade toward sustainability, ethical sourcing, and fairness. This change is helping all businesses compete equally and pushing them to connect with what today’s consumers care about, creating a fairer and more progressive marketplace.

Ultimately, these shifts may feel overwhelming, but they also open up new doors for businesses that are willing to innovate. The future of e-commerce isn’t just about how fast you can ship a product—it’s about how well you can build trust with your customers, how ethically you source, and how quickly you adapt to a changing world.

The question is no longer “How can I get my products into the U.S. market as cheaply as possible?” but rather, “How can I future-proof my business in a changing regulatory environment?” Those that adapt to these shifts—not just by adjusting to new rules, but by embracing the larger trends of sustainability and local sourcing—will be the future leaders in the e-commerce world. By staying on top of these changes and adapting early, businesses can continue to thrive in the global marketplace. Now is the time to innovate, adapt, and lead the way into a new era of global trade—one built on fairness, responsibility, and opportunity for all.

“The Apliiq team will continue to monitor ‘de minimis’ changes and provide updates as more information becomes available.”